Here is a recent example of a SWOT Analysis that I completed for my MBA course in Strategic Management. A fictitious company hires me to come in and review the fundamentals to recognize opportunities and identify threats apparent in the industry.

Enjoy this SWOT Analysis in Management example, and as always, reach out to us if we can help you!

CASE STUDY: INNOVATIVE HEALTHCARE INC. (IHC)

Case Study Summary

In this case study, we will dive deep into Innovative HealthCare Inc. (IHC), to help consult the company on its overall strategy and make recommendations for improvements.

SWOT Analysis

Strengths

Solid business with high employee morale.

Management that is knowledgeable about the business and runs it well.

92% retention rate of employees which showcases solid business practices and a well managed company.

Solid financials. The company is earning a good profit and has a well capitalized balance sheet.

Weakness

Employee salary makes up a large portion of the company’s expenses (55.4%). This could hurt the company if it cannot continue to earn the type of revenues it needs from servicing patients.

Governmental contracts make up $11.5mm of the $32mm in revenues (36%). During a recession time, it could hurt the company to rely on the government for so much revenue generation.

Lack of a proper training program. This could adversely affect the care of patients, open up employees to unnecessary stressors, and lead to more lawsuits and claims, which we are already seeing taking place.

Opportunities

High employee morale. This could make it easier for the firm to continue to maintain top talent and recruit top talent in the future. Since the area of DFW remains strong economically, this could help the company via it hiring better employees away from competitors.

Being the fourth largest health care provider could be a good thing. The company is just the right size where it could be more nimble and react to changes in the marketplace faster than its larger counterparts.

Most of the staff can receive orders from technology, thus have little need to come into the office. The company could look to radically reduce its office space and not have the need for wheelchair ramps and upkeep.

The Dallas-Fort Worth area is showing strong economic performance, which will help the company via a strong city base.

Occupational and Speech therapies are showing the best level of growth, as these divisions are adding the most employees.

DFW area has an 11.2% population over the age of 62, compared to the national average of 16.2%. This could mean that the DFW is relatively young, with a lot of baby boomers set to retire and in need of home care in the coming decades (Data Access and Dissemination Systems (DADS), 2010).

Threats

The Affordable Care Act is making it challenging for health care professionals to earn a reasonable living. This is causing higher attrition rates and lower entry rates for the health care profession in general.

IHC is the fourth largest home health business. This could cause it to not be seen as the ‘leader’ in its industry.

There are several ongoing claims filed against IHC from former patients which could become material to operations.

There are several sexual harassment claims filed against IHC which could become material to operations.

Wheelchair ramps not repaired. If left in disrepair, this could cause issues if employees or patients are injured as a result. This could lead to more legal claims, which could negatively impact the company’s future.

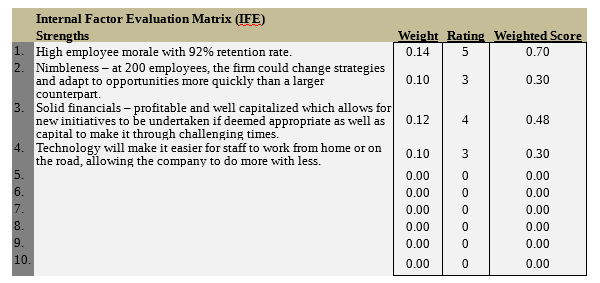

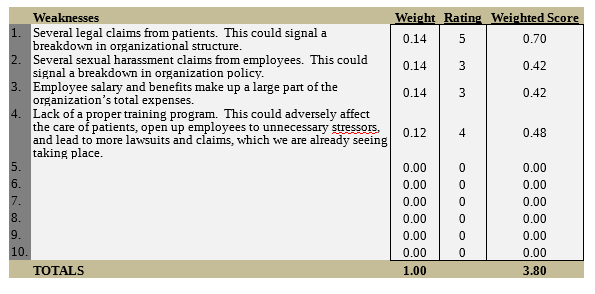

Internal Factors Evaluation Matrix

IFE – Strengths and Weaknesses

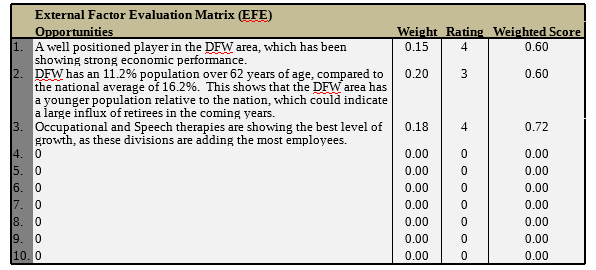

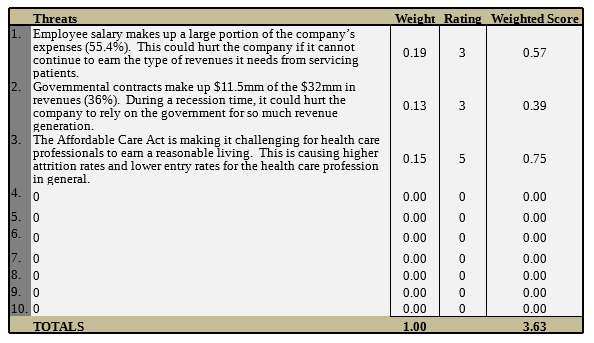

External Factors Evaluation Matrix

EFE – Opportunities and Threats

Analysis on Organizational Strategy

IHC operates under the strategy of hiring excellent employees to create excellent experiences for patients. It is operated under a hierarchy where the Physical Therapists (PTs), Occupational Therapists (OTRs), and Speech Pathologists manage their respective divisions, and the more affordable assistants relative to each position do the actual work with the patients. The company has adopted technology to make itself much more efficient and allows it to serve more patients.

Overall this is the correct strategy if IHC can position itself as a premium services provider and charge a higher price for its services to clients. By recruiting, training, and presumably paying the best salaries for the best employees, this will bode well for this type of strategy.

Greatest Internal and External Impacts

Internal

*Solid financials – The company is profitable and well capitalized which allows for new initiatives to be undertaken if deemed appropriate as well as retained capital to make it through challenging times. It is well capitalized with an equity base of $7.5mm and solid revenues year-over-year. Overall, I believe the company’s financials have it well positioned to compete in the highly competitive health care market.

This solid positioning could help it be primed for an acquisition to help it build economies of scale and to purchase more customer lists. With a combination through its technology platform, it would have the ability to offer relatively the same level of services for less cost. This could help it compete better against the larger competitors in its industry and grow its own operations.

External

*The Affordable Care Act is making it challenging for health care professionals to earn a reasonable living. This is causing higher attrition rates and lower entry rates for the health care profession in general.

The lower wages demanded by the ACA could be an issue for this company, as it goes against the exact strategy of IHC. IHC looks to recruit the best talent and pay the best salaries in order to be a premium services provider. If the company is then forced to pay mandated salaries, or worse, pay higher salaries but cut into its margin, it will begin to lose its competitive advantage.

Since IHC has a 92% retention rate with happy employees, it is already doing quite well in retaining its talent. If pay becomes an issue, then IHC would do well to look at other ways to boost morale. Perhaps it could offer benefits at lower cost – free lunches, company outings, daycare, etc., which would still retain top talent but not cut into margin at the same time.

IHC Target Market

IHC has a target market of the following characteristics:

Elderly

Sex: Male and Female

Age: Over the age of 60 that struggle to care for themselves

Marital Status: Married or Single, most likely widowed or still married

Location: Within the DFW area

Occupation: Retired and stay at home

Condition: Suffer from a condition that makes it challenging to live day by day

Education level: Any level, most likely college educated or better

Disabled

Sex: Male and Female

Age: Any age

Marital Status: Any

Location: Within the DFW area

Occupation: No occupation or low level of occupation as disability renders employment challenging.

Condition: Disability present – speech issues, physical condition which inhibits everyday living or occupational abilities.

Education level: Any level, most likely high school educated or less due to disability

Mission Statement Review

Below is the mission statement review. We will review the nine points of a successful mission statement and revise, if necessary.

Does the Mission Statement identify:

Customers – Yes, Disabled and Elderly

Products or services – No, it does not make mention of the products or services.

Markets – Yes/No, it makes a general reference to the communities served, which could suffice. It also states it is in the health care field, which is good.

Technology – No, it would be good to add in a piece in here.

Concern for survival, growth, and profitability – Yes, ‘well-known and iconic’ satisfies this piece as it speaks to the organization’s dream of living beyond.

Philosophy – Yes, states trust and care for patients, which is the philosophy of the organization.

Self-concept – Yes, it describes the principles for what the company is and creates an easy to understand vision of what the company desires to be.

Concern for public image – Yes, it describes itself as an iconic brand.

Concern for employees – No, I do not see anything that expressly states about concern for employees.

Here is what my updated mission statement would look like to better incorporate the nine points of a great mission statement:

Mission Statement

*“To create and establish a well-known iconic name in the health care field that cares for those who are elderly and disabled with focus in the fields of Physical Therapy, Occupational Therapy, and Speech Pathology (2). We are founded upon principles of trust and care and strive to exhibit these two principles each day in caring for our patients. We recruit and train the best employees (9) with the top industry technology (4) to provide the best possible care. Our focus is to increase the quality of living for our patients, and to make the communities we serve a better place to live”.

Vision Statement

*I would leave the vision statement as-is. I like the fact that it is broad, and inspires employees and associates to ‘create a better quality of life’ for those they serve.

ROA

The calculation for Return on Assets is:

Net Income

Total Assets

According to this calculation, the ROA for IHC would be:

$8,000,000

$7,500,000

Resulting in $1.06. So for every $1 in assets, the company is earning $1.06 in profits. This is important because it shows that the company is making a profit on assets, but not very much. In general, the higher this ratio is the better. In some respects this makes though, as the company utilizes its people to generate profit, which are not categorized as assets. Rather, the bricks and mortar, technology, receivables, etc. are what the ROA is being based off of. The company would do well to look at how it is deploying its resources to better utilize assets to generate income.

This could be done by:

Investing more in technology which might allow staff to do more, and reducing overall staff count to earn more income. This would help to ‘do more with less’ and thereby increase the ROA.

Sell non-productive assets.

Collect on A/R quicker and utilize cash/investments better.

ROE

The calculation for Return on Equity is:

Net Income

Total Stockholder’s Equity

According to this calculation, the ROA for IHC would be:

$8,000,000

$2,500,000

Resulting in $3.20. So for every $1 in equity, the company is earning $3.02 in profits. This is a very solid ratio, which shows the company is highly profitable for each equity stake in the business. This ratio shows a high level of growth for the organization.

References

Data Access and Dissemination Systems (DADS). (2010, October 05). Your Geography Selections. Retrieved October 18, 2018, from https://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?src=CF

Momoh, O. (2018, August 14). Return on Assets – ROA. Retrieved October 19, 2018, from https://www.investopedia.com/terms/r/returnonassets.asp

Staff, I. (2018, August 03). Return on Equity (ROE). Retrieved October 20, 2018, from https://www.investopedia.com/terms/r/returnonequity.asp